Unlocking the Benefits of Mileage Rates for Travel and Finances

Unlocking the Benefits of Mileage Rates for Travel and Finances

Blog Article

Exploring Mileage Rates: What You Need to Know for Business and Personal Use

Mileage rates, often overlooked as a minor detail, play a significant role in individual and corporate finances. Whether you're a freelancer claiming tax deductions or a business owner reimbursing employees, understanding these rates is essential for effective expense management.

### The Basics of Mileage Rates

Miles Rates are preset amounts that the IRS allows for the cost of operating a vehicle for business purposes. These rates are updated annually to reflect fluctuations in fuel prices, maintenance costs, and other relevant factors.

### The Importance of Mileage Rates

- **Tax Deductions:** People and companies can deduct mileage expenses from their taxable income, considerably reducing their tax liability.

- **Fair Compensation for Employees:** Employers can reimburse employees for business-related travel expenses using the IRS rate, ensuring fair compensation.

- **Organized Cost Management:** Mileage rates provide a standardized method for monitoring transportation costs, simplifying expense management.

- **Financial Planning:** By understanding mileage rates, people and companies can plan more effectively for travel expenses and make informed decisions about travel plans.

### How to Use Mileage Rates

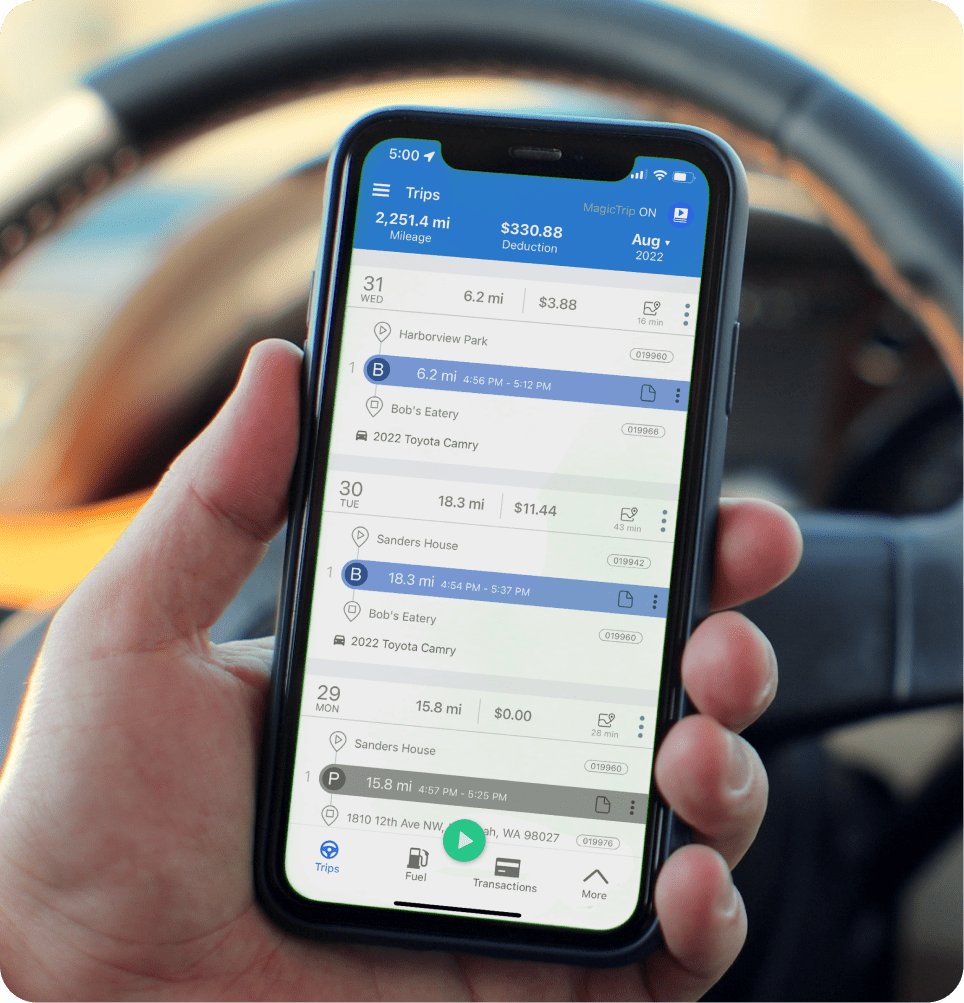

1. **Determine Business Use:** Precisely track the business miles driven for each trip.

2. **Calculate Mileage Costs:** Multiply the overall business miles by the latest standard mileage rate set by the IRS.

3. **Document Trips Thoroughly:** Keep detailed records of all business trips, including trip dates, starting and ending points, and the reason of each trip.

4. **Stay Updated:** The IRS revises the standard mileage rate yearly, so ensure you are using the latest rate for your tax year.

### Other Ways to Calculate Mileage

While the IRS standard Miles Rates is widely used, there are other methods for calculating mileage expenses:

- **Actual Expense Method:** This method allows you to deduct the actual costs associated with operating your vehicle, such as gas, oil, repairs, and insurance. However, it demands thorough record-keeping and may be more complex to calculate.

- **Custom Mileage Rates:** Some businesses may create their own flat rate per mile for employee reimbursements, which can vary based on elements like vehicle type and local fuel prices.

Understanding mileage rates is essential for anyone who relies on vehicle transportation for business or personal purposes. By precisely tracking mileage and applying the right rates, you can improve your finances, minimize tax liabilities, and ensure fair compensation for travel expenses.